UK inflation has fallen by less than expected, official figures show, adding to concerns that it remains too sticky for the Bank of England to start cutting interest rates any time soon.

According to the Office for National Statistics, the consumer prices index (CPI) rose by 3.2% in the 12 months to March 2024, down from 3.4% in February. While this is the lowest level in two-and-a-half years, it remains above the Bank’s 2% target and is slightly higher than economists were expecting.

CPI annual inflation rates for the last 10yrs

Source: ONS

The largest downward contribution came from food, with prices rising by less than a year ago. Prices for food and non-alcoholic beverages rose by 4% in the year to March 2024, down from 5% to February, although the ONS did flag a small rise in bread and cereal price inflation.

But falling food prices were partially offset by rising fuel prices. Energy prices are once again in the spotlight, with continued tension in the Middle East between Israel and Iran.

Tomasz Wieladek, chief European economist at T. Rowe Price, pointed to services inflation, which fell from 6.1% to 6%, as being “relatively sticky” and suggests the UK’s underlying domestically generated inflation is “significantly stronger than expected”.

“Together with the rising momentum in wage inflation, the sticky services inflation numbers raise the risk the UK inflation battle is far from over and perhaps not yet won. The MPC [Monetary Policy Committee] will be worried about this scenario and I believe this strong reading will make the MPC cautious about cutting early in the summer,” he said.

“Indeed, given these strong domestic inflationary pressures in both wages and services, the MPC will now likely wait until late summer to get the required confidence to cut rates.”

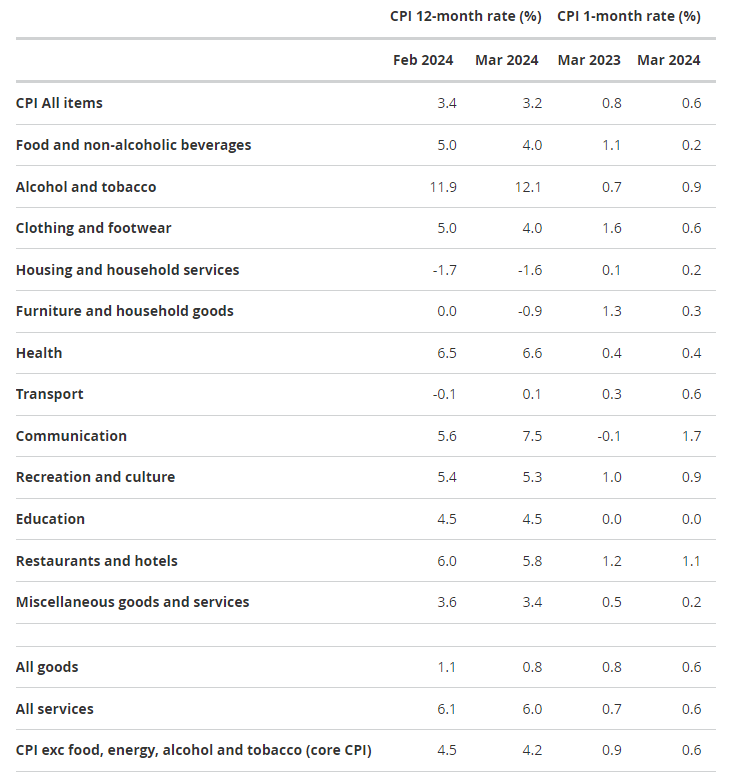

CPI annual and monthly inflation rates by division

Source: ONS

It had been thought that the Bank would could start to cut interest rates as early as May. The MPC will meet on 9 May although the market is now not expecting the first rate cut until August or September.

That said, Bank governor Andrew Bailey recently reminded the market that inflation does not need to reach the 2% target before the first cut to the base rate, which currently stands at a 16-year high of 5.25%.

“We don't have to actually get inflation all the way back to target… to cut rates for instance, what we have to do is be convinced that it is going there,” he told BBC News last month. “We should act ahead of time in that sense because we have to be forward looking.”

Danni Hewson, head of financial analysis at AJ Bell, said the latest ONS figures show inflation is “moving in the right direction” and should look even better next month, when the falling energy price cap is factored into the calculation.

“This print is unlikely to persuade Bank of England policy makers, who just a couple of months ago were voting for further hikes, that the time is now right to start to cut. Andrew Bailey might be making positive noises about the pieces of the economic puzzle falling into place for a change in policy, but markets are far from convinced,” she added.

“Looking at the numbers after the inflation print was released, expectation of a June cut has fallen back significantly and more than 50% now think even August will be too soon.”

T. Rowe Price’s Wieladek ended on a more pessimistic note, highlighting another risk that is not being widely spoken about in the UK’s monetary policy debate.

“If services inflation and wages continue to remain persistently at these high levels, the risk the Bank of England will have to hike this year is rising,” he warned.

“After all, the Bank of England is data-dependent. If the data continue to indicate policy is not tight enough to bring inflation back to target, the MPC may have to tighten policy further.”