American economist Harry Markowitz famously said that diversification is the only free lunch in investing. An easy way to get that diversification is through buying different asset classes and multi-asset funds do this as a one-stop-shop for equity, fixed-income, property and other alternative asset classes.

Boring Money analysts said they are suitable for investors wanting to access a wide range of investments in one simple package, spreading money across different countries and markets.

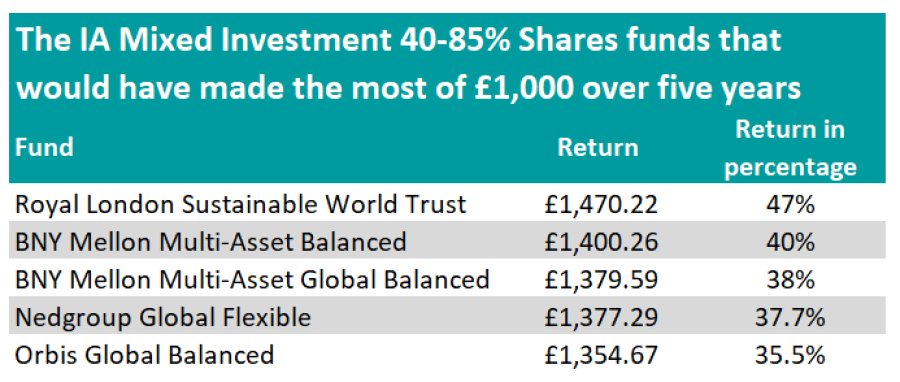

Below, Trustnet looks at the multi-asset funds that would have made the most of £1,000 over five years.

Multi-asset funds in the Investment Association universe are split across three sectors: IA Mixed Investment 0-35% Shares, IA Mixed Investment 20-60% Shares and IA Mixed Investment 40-85% Shares, with a higher proportion of shares reflecting a higher risk profile.

Over the past five years, embracing the higher risk level associated with equities has paid off, as the majority of the best performing multi-asset funds in that period were those with a higher allocation to equities.

For instance, the best performer, Royal London Sustainable World Trust, has more than 80% of its asset allocation into equities, with the rest in fixed interest securities and cash.

FE fundinfo Alpha Manager Mike Fox invests globally, looking for long-term growth themes associated with sustainability across sectors such as healthcare, technology and renewable infrastructure. The fixed-income portion of the fund is invested in corporate and sovereign debt.

Gavin Haynes, co-founder of Fairview Investing, said: “The fund has one of the most highly regarded teams for multi-asset investing and this is a stand out fund in the sector. Fox is the long-term lead manager of the Royal London Sustainable strategies and has managed this fund since 2009.

“It has an exceptional track record and has significantly outperformed the peer group over the past five years.”

Two funds from BNY Mellon’s subsidiary Newton also feature among the best performing multi-asset funds over the past five years: BNY Mellon Multi-Asset Balanced and BNY Mellon Multi-Asset Global Balanced.

The two strategies are run by the same team and currently hold 70% in equities, with bonds and cash to temper risk and generate an income.

Commenting on the former fund, Darius McDermott, managing director of FundCalibre, said: “Manager Simon Nichols has created a rock-solid global multi-asset vehicle which uses themes to target the forces driving global change in markets. He does this by investing in what he calls ‘future facing business models’ which can tap into megatrends in their respective industries.

“The team also believes that achieving good returns is as much about what you don’t own as what you do. It has proven to be a very successful formula during Nichols’ tenure on the fund and helped in 2022, when the fund outperformed its average peer.”

The IA Mixed Investment 40-85% Shares funds that would have made the most of £1,000 over five years

Source: FE Analytics

Orbis Global Balanced, managed by FE fundinfo Alpha Manager Alec Cutler, is also among the multi-asset funds that would have made the most of £1,000 over five years, albeit with a lesser weighting in equities than the previous funds.

McDermott said: “Manager Alec Cutler believes one of the key advantages of the portfolio is the ability to focus on best ideas and making them ‘fight for capital’, with every holding needing to be an active contributor to the fund. We think this is a key differentiator - every asset has to fight for its place – there isn’t a set portion for each asset class.

“The fund can also use hedging and manage currencies, which it has done in recent times to mitigate risks in China, for example. The result is a portfolio of holdings that can perform across a variety of market conditions.”

Another particularity of the fund is its fee structure, whereby investors pay when the fund outperforms but are refunded in periods of underperformance.

Investors who wanted a smaller allocation to equities or a larger exposure to different asset classes might have preferred a fund in the two other multi-asset sectors.

Schroder MM Diversity and NB Multi Asset Income are the funds that have made the most of £1,000 over the past five years in the IA Mixed Investment 20-60% Shares or IA Mixed Investment 0-35% Shares sectors respectively.

The former is a multi-manager fund headed by Robin McDonald, which aims to take a differentiated approach to the traditional 60/40 equity/bond portfolio.

The IA Mixed Investment 20-60% Shares and IA Mixed Investment 0-35% Shares funds that would have made the most of £1,000 over five years

Source: FE Analytics

Haynes said: “Their focus is generating returns above inflation and their default asset allocation position is one-third equities, one-third bonds and one-third alternatives.

“This has proved particularly effective in a climate where higher inflation has upset equity and bond correlations and adding an added level of diversification has added value. They have also benefited from taking a tactical value approach to equities.”

The Neuberger Berman fund is divided into equity, fixed income and opportunistic buckets, with the second category accounting for approximately 60% of the fund.