Income strategies could be worth the consideration if central banks start cutting interest rates later this year. While the current base rate in the UK stands at 5.25%, the market was forecasting the Bank of England to cut rates by 170 basis points (bps) in 2024 as of 1st January, according to Aegon Asset Management. This figure has now fallen to just 115bps, but that would still bring interest rates down to 4.1%.

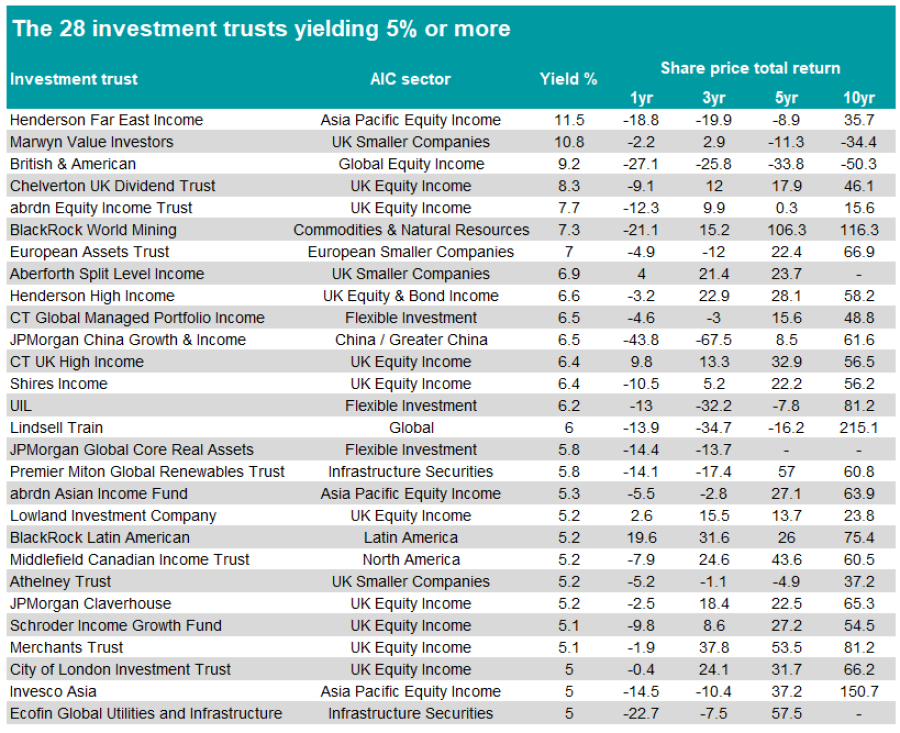

As such, the 28 investment trusts yielding 5% or more would provide investors with an income in excess of interest rates. That includes Henderson Far East Income which invests in Asia Pacific equities and yields 11.5% and UK equity income specialist abrdn Equity Income Trust, which has increased its dividend for 23 years and offers a 7.7% yield.

Source: The Association of Investment Companies

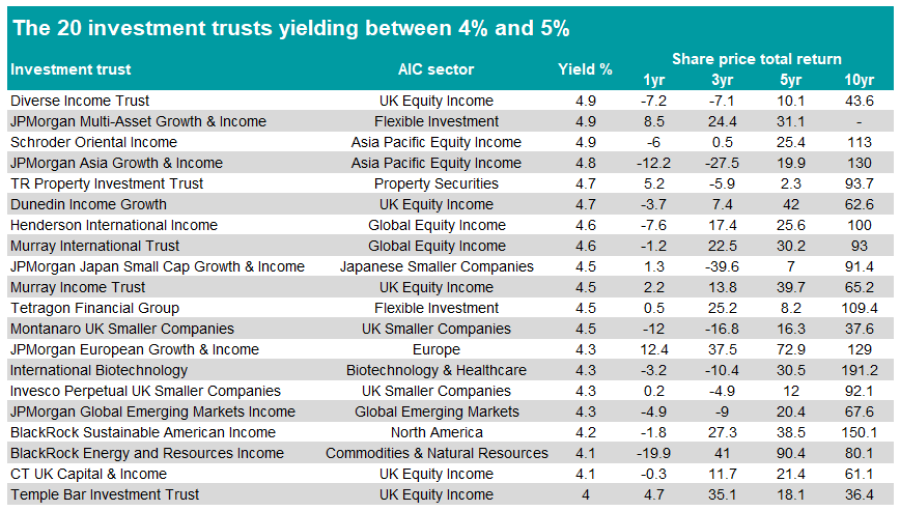

A further 20 trusts yield between 4% and 5%, including global equity income strategy Murray International Trust, that yields 4.6% and UK small-cap portfolio Montanaro UK Smaller Companies, which boasts a 4.5% yield.

The Association of Investment Companies (AIC) noted that 14 of the 48 high-yielding investment trusts are from the IT UK Equity Income sector, while the IT UK Smaller Companies, IT Asia Pacific Equity Income and IT Flexible Investment sector all have five trusts in the list. Meanwhile, the IT Global Equity Income sector offers three high-yielding trusts.

Annabel Brodie-Smith, communications director of the AIC said: “These investment trusts offer access to equities in a wide range of regions and sectors from the UK and across the globe including commodities, infrastructure and biotechnology.

“More than a third of these 48 investment trusts have raised their dividends every year for the past 10 years, and eight have raised their dividends for 20 years or more. Investment trusts have structural benefits which help them maintain and grow their dividends year after year.”

She warned, however, that dividend are never guaranteed. Therefore, she called on investors to do their own research and to consult a financial adviser if they have any doubt about the suitability of investment trusts.

Source: The Association of Investment Companies

As UK inflation has unexpectedly ticked up again for the first time in 10 months, with the Consumer Prices index rising 4% in December, the BoE might have to cut rates later than previously anticipated.

Neil Wilson, chief market analyst at Finalto, said: “Bank of England faces inflation ticking up…the dreaded wage price spiral is here. CPI rose to 4% or is it just the Red Sea mess? Odds of a May cut have fallen from around 84% yesterday to 58% this morning after the print.

“This is bound to make the BoE extra cautious over timing its rate cuts. It could delay the first cut and slow down the pace of cuts this year – but it’s only one data print.”

Adam Darling, investment manager, fixed income at Jupiter Asset Management added that the decline in inflation towards the 2% target will not be a straight line. However, he still expects the Bank to cut rates this year, as the underlying economic fundamentals, such as a cooling job market, weak money supply and soft business and consumer confidence, all point to a fall in UK inflation.