Building an allocation to emerging markets is no simple feat, as the asset class encompasses a range of regions with significantly different structures and drivers.

Moreover, emerging markets and Asia ex-Japan share a lot of overlaps. For instance, China, India, Taiwan and South Korea account for nearly 73% of the MSCI Emerging Markets index and over 84% of the MSCI AC Asia ex-Japan.

As a result, investors may face the dilemma of whether to consider emerging markets and Asia ex-Japan as two distinct asset classes or club them together.

Below, we asked experts how to build an exposure to those dynamic and growing economies.

Federated Hermes Asia ex-Japan Equity, M&G Global Emerging Markets and L&G Global Emerging Markets Index

For Chris Rush, IBOSS investment manager at Kingswood Group, there is no reason to separate emerging markets and Asia ex-Japan given the overlap between the two sectors. Therefore, he uses a combination of funds across both sectors.

His first choice is Federated Hermes Asia ex-Japan Equity, managed by FE fundinfo Alpha Manager Jonathan Pines since launch in 2012.

Rush highlighted the fund’s track record, showing the management team’s ability to navigate an “extraordinarily wide variety of market conditions”.

The fund currently has overweight positions in China and South Korea, which are arguably the least popular regions among emerging markets as both have fallen from their respective peaks in 2021. While going against the grain it is not without risk, Pines believes it has opened significant opportunities for investors.

Rush said: “Ultimately, we want our active managers to make active decisions on behalf of our clients and us. The combination of a proven track record and the ability, willingness and confidence to invest in unloved areas of emerging markets lead us to rate the fund and the team highly.”

His second pick is M&G Global Emerging Markets, managed by Michael Bourke since 2018.

Again, Rush highlighted the fund’s track record, but also Bourke’s willingness to extensively move the positioning, which has had a positive impact on total returns for investors.

Like the Federated Hermes fund, M&G Global Emerging Markets takes a big punt on South Korea but adds Latin America into the mix as well, with overweights in Mexico and Brazil.

Rush said: “We believe the combination of two active managers willing to back their convictions but with differing views on where the opportunity lies is a potentially potent combination.”

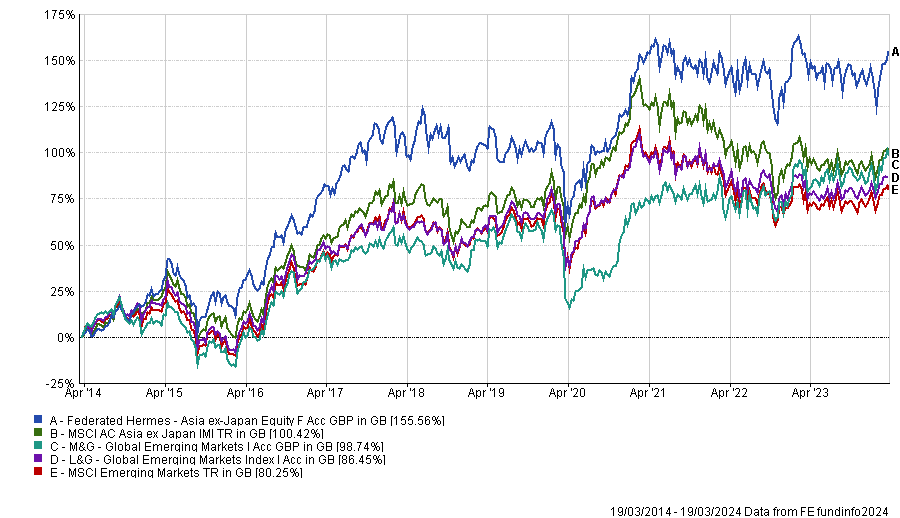

Performance of funds over 10yrs vs benchmarks

Source: FE Analytics

Finally, he complemented those two active portfolios with L&G Global Emerging Markets Index, a tracker fund. Emerging markets and Asia indices are not “entirely stuffed with expensive assets”, he said.

“We believe that a passive fund can complement the active positions of the funds mentioned above, maintain broad exposure to the region and reduce costs,” Rush said.

“For example, M&G and Hermes are markedly underweight in India relative to the index, while the L&G fund has a 22% allocation to Indian companies. Though many Indian companies do look expensive, they have done so for some time and India is of the top-performing indices over recent years.”

FSSA Asia Focus and Redwheel Next Generation

Ben Yearsley, director at Fairview Investing, also sees Asia and emerging markets as one asset class and combined funds from both sectors.

He selected FSSA Asia Focus, which is a quality growth strategy managed by FE fundinfo Alpha Manager Martin Lau and Richard Jones.

“For a core Asian/emerging markets holding, I think the quality growth style is the place to be for long-term investors. You’re in the biggest growth market with extremely favourable demographics, so why wouldn’t you buy growth?” Yearsley asked.

“This fund will always have India and China has the key components – normally more India, though in recent times Chinese valuations have tempted the team back in.”

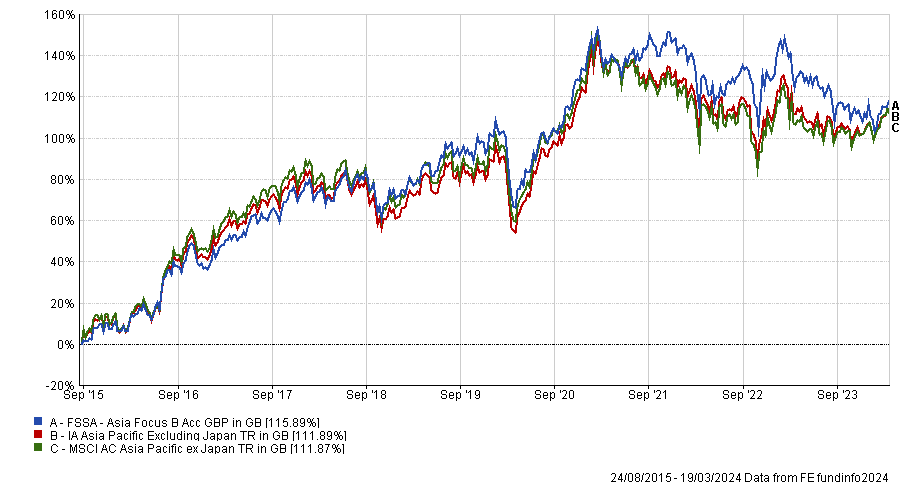

Performance of fund since launch vs sector and benchmark

Source: FE Analytics

To complement FSSA Asia Focus, Yearsley chose Redwheel Next Generation Emerging Markets Equity, a fund launched in 2019.

He said: “The fund sits in between frontier and emerging markets and invests in the larger more liquid frontier markets and the smaller emerging market countries. As such, crossover with FSSA will be limited. It is more growth at a reasonable price rather than the quality growth approach of FSSA.”

Performance of fund since launch vs sector and benchmark

Source: FE Analytics

UTI India Dynamic Equity & FFSA Greater China Growth

Unlike Rush and Yearsley, Darius McDermott, managing director at FundCalibre, chose to focus on the two Asian giants: India for aggressive growth and China as a value play.

McDermott said: “India boasts the fastest-growing major economy globally, fuelled by a growing young population on the cusp of entering the workforce. This ’demographic dividend’ translates to a compelling structural growth story, with a young workforce boosting productivity and consumption.

“Unsurprisingly, India has been a top performer in emerging market portfolios, reflecting its rapid economic expansion. However, the Indian stock market currently trades at a premium compared to its historical average, indicating potential overpricing.”

To leverage India’s long-term prospects, he suggested using UTI India Dynamic, which offers an exposure across the market-cap spectrum.

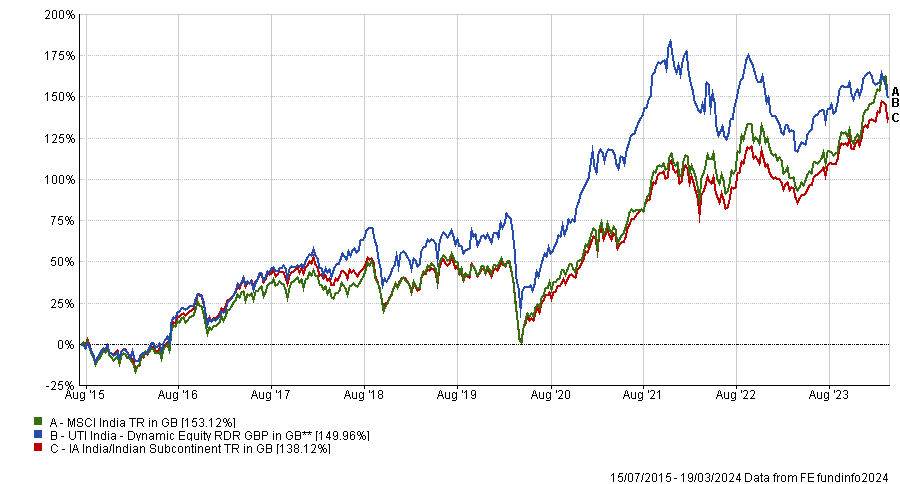

Performance of fund since launch vs sector and benchmark

Source: FE Analytics

On the other hand, China offers almost the exact opposite set of characteristics. While hosting some of the world's leading companies such as Tencent or Alibaba, Chinese equities are currently trading on low valuations, as a result of the economic slowdown in China and geopolitical tensions with the West.

McDermott said: “While China may require more patience from investors due to potential volatility, investing in undervalued assets with solid fundamentals offers the potential for significant long-term returns.”

To get exposure to the cheap Chinese equities, he pointed to FSSA Greater China Growth, managed by Martin Lau and Helen Chen. The fund is not a pure China play, as it also invests in Hong Kong and Taiwan.

In an interview with Trustnet last year, Lau explained that Taiwan is more export-oriented than the China A-share market, while Hong Kong is “well regulated, very transparent and quite mature”.

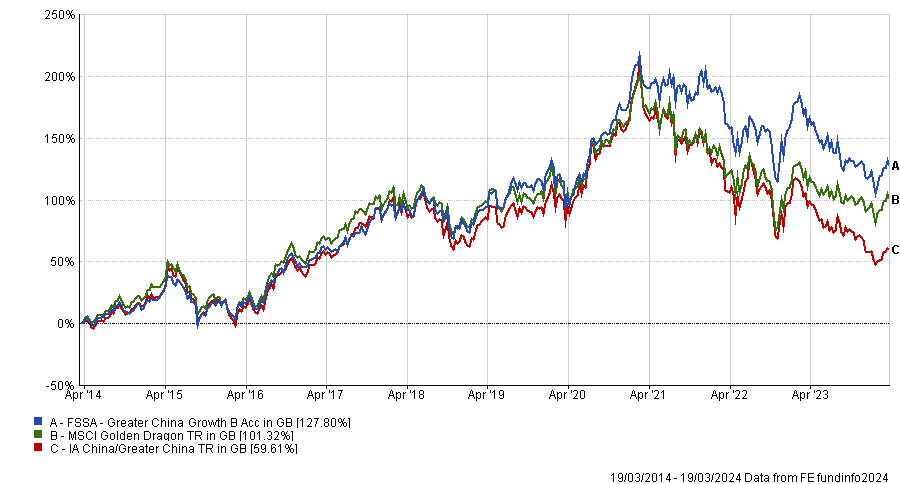

Performance of fund over 10yrs vs sector and benchmark

Source: FE Analytics

McDermott concluded: “These two approaches are complementary for several reasons. First, by combining a high-growth market like India with a potentially undervalued one like China, you diversify your portfolio's risk profile.

“India's aggressive growth potential can act as a counterweight to any stagnation in China's maturing economy. Conversely, China's value proposition offers a hedge against any downward corrections in India's potentially overheated market.”