Income, smaller companies and tracker funds are all options for last-minute investors looking for a new fund to add to their portfolio before the ISA deadline this week, according to experts.

The 5 April deadline is rapidly approaching and it is crucial investors use up as much as they can of their £20,000 allowance.

But knowing what to buy is a perennial problem. Below, Trustnet asks experts for one fund idea all investors should consider adding to their portfolio.

For new investors, Charles Stanley investment director Rob Morgan said investors “simply cannot ignore” the US – which is “by far” the largest market in the world.

While investors can get access to it through a global tracker – American stocks make up some 71% of the MSCI World index – he suggested a dedicated tracker is the best way to go.

“We have been living in an age of US exceptionalism from the perspective of economic and corporate growth, and that looks set to continue,” said Morgan.

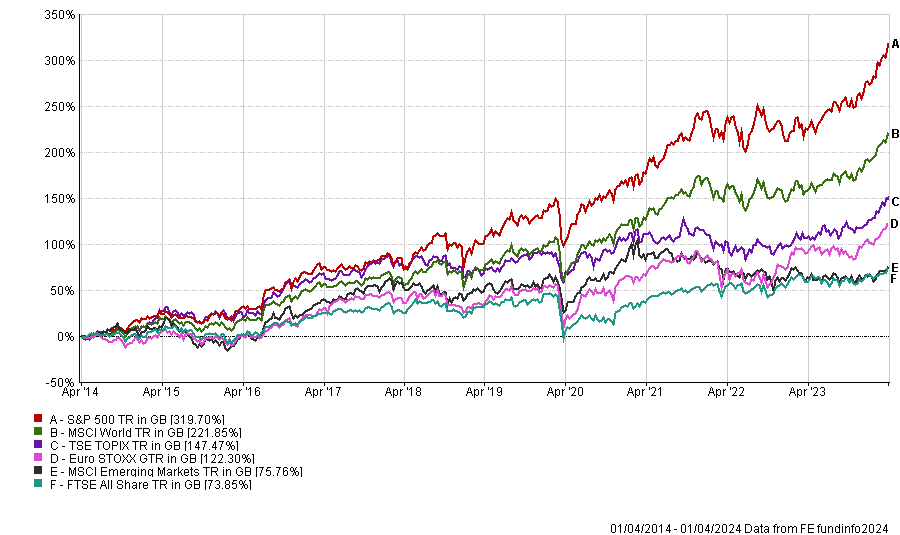

Indeed, as the below chart shows, the US S&P 500 index has been the best performing of the major markets over the past decade, more than double the TSE TOPIX index and 200 percentage points above the Euro STOXX index.

Performance of indices over 10yrs

Source: FE Analytics

“There are valid concerns regarding valuations, but an essential building block in any portfolio is a low-cost US tracker fund such as Fidelity Index US. For many markets I prefer more selective active strategies, but the US is an area where it’s hard to outperform consistently so it’s often best to use your cost budget elsewhere,” Morgan said.

Jason Hollands, managing director at Bestinvest, agreed that US equities are too important for investors to ignore and also suggested investors go with a passive option.

While there are “a handful of great actively managed US funds available”, which have beaten the index over the longer term – Hollands picked out Loomis Sayles US Equity Leaders and the Dodge & Cox Worldwide US Stock fund as examples – these are “few and far between”.

“A simple, low-cost approach for investors looking for a buy-and-hold fund is therefore to invest in a US equity tracker. Even legendary investor Warren Buffet has famously said ‘for most people, the best thing to do is own a S&P 500 index fund’ and there are two such investments in the portfolio of his Berkshire Hathaway investment vehicle,” he noted.

However, when it comes to picking a passive fund, he said investors should focus on cost, as this is one of the biggest factors in determining returns.

“One of the lowest cost US trackers available to UK-based investors is the C share version of the Legal & General US Index fund, which has tiny ongoing costs of 0.05%, but if your platform doesn’t offer this version, other US index funds can typically be found with ongoing fees of 0.06%,” he said.

Also on the passive train, John Monaghan, research director at Square Mile Investment Consulting and Research, said the LGIM Multi Index range was a strong option, although exactly which fund investors choose will depend on their risk tolerances.

It comprises five funds that have been designed to meet investors’ tolerance for risk across the spectrum.

“This is a low-cost solution investing across a range of index trackers, but with active management decisions made around how the allocations to bonds and equities are managed,” he said.

“Typically, the lower risk funds would have a higher allocation to bonds, with the higher risk versions holding a greater proportion of assets in equities. We hold the LGIM team in high regard and they have adeptly navigated their way through a range of market conditions.”

Darius McDermott, managing director at FundCalibre, said most ISA investors should be looking to create a long-term tax-free income stream that can supplement household income, boost retirement income or help your portfolio grow faster through compounding.

“Therefore, a global equity income fund should be a core holding in your ISA. Not only do they provide global diversification, history shows that they're a good way to make returns – over the 25 years since ISAs were launched, an investment in the MSCI World index would have made you a steady return of 468%, however, without dividends reinvested, that return from drops dramatically to 250%,” said McDermott.

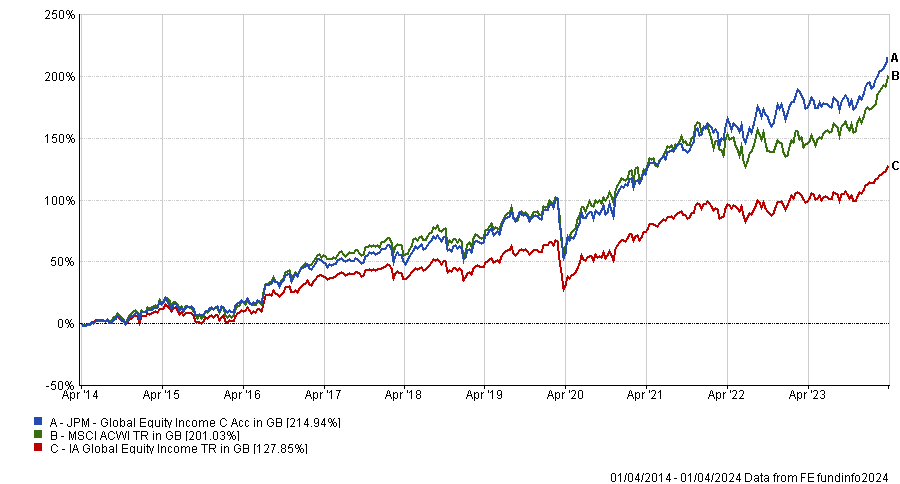

His choice was JPM Global Equity Income managed by FE fundinfo Alpha Manager Helge Skibeli, Sam Witherow and Michael Rossi.

It has been a top-quartile performer in the IA Global Equity Income sector over three, five and 10 years, beating the MSCI AC World benchmark over the decade.

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

“Rather than chasing yield, the investment team leverages the bank’s 90-strong global analyst network to identify high-quality companies with sustainable growth potential. This extensive expertise helps to carefully craft a portfolio of 40-90 stocks from a universe of more than 2,500,” said McDermott.

“While ‘compounders’ form the core of the portfolio, the managers can strategically diversify with holdings in both high-growth and high-yield sectors. This nimble attitude allows them to capitalise on market opportunities and adapt their strategy as valuations fluctuate, helping to generate strong returns.”

Investors with a basic portfolio may wan to add something new and Harry Children, investment manager at Albemarle Street Partners, said M&G Japan Smaller Companies was worthy of consideration.

“The less well-known sibling of Carl Vine’s large-cap darling, which has profited from significant investor flow over the past 18 months, this fund is a diversified, value tilted, small-cap strategy that combines bottom-up stock selection alongside advanced risk management controls to generate abnormal returns over the long term,” he said.

M&G Japan Smaller Companies has been the best IA Japan fund of the past decade, up 245.4%, while it is in the top quartile of its peers over three and five years as well.

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

However, now could be a good time to get into the market as Japanese equities have “overshot most analyst expectations, as deregulation and macroeconomic strength continue to drive investor sentiment”, he said.

“The lack of available funds within the Japanese smaller company’s space also means that there is potential to exploit a segment of the market that has extremely low coverage, diversifying away from traditional allocations in the region.”