Investors will be paying close attention to the outcome of the 2020 US presidential election on 3 November which will determine who will lead the world’s largest economy for the next four years.

Indeed, some 18 per cent of global fund managers perceive the US election as one of the market’s biggest “tail risks”, according to Bank of America’s Global Fund Manager Survey conducted in early September.

And as the election day draws closer, political high drama is likely to continue to unfold as Republican incumbent Donald Trump and Democratic presidential nominee Joe Biden go head-to-head in live televised debates.

However, history has shown that the election outcome may matter less to financial markets than some have feared.

“Apart from 1980 with Ronald Reagan, for the most part, elections haven’t had a significant impact on investors,” said Scott Glasser, co-chief investment officer at Clearbridge Investments.

“Part of that is because it’s really hard to get significant change over time. The Fed is independent and has been a constant over time.

“There’s enough in the way the political system is set up so that everything kind of gets watered down and you don’t get that significant political change.”

Randall Dishmon, manager of Invesco’s Global Focus Equity Fund shares this view, adding: “I’ve never yet seen a political cycle that mattered to the outcome.

“If we were to put Karl Marx up to run for our election and he won in a landslide, then I would say it’s quite possible that we’ll get some meaningful change.

“But the US system is designed for slow change – we’ve got two different houses and it's very difficult to get rapid change in our system.”

“Even when the Clintons came to power in the 1990s and they wanted to reform healthcare and came in with the idea that they were going to take a flame thrower to the healthcare system and start over, as motivated as they were, the only change they could accomplish basically affected the tide,” the manager recalled. “By that I mean, it didn’t single out any particular company, it lifted the tide or lowered tide for everyone.”

While the US presidency may be the most powerful job in the world, there is little a president can do without congressional support, and when it comes to investors, the power of the purse – the ability to tax and spend public money for the national government – is their main area of concern.

As a report by German asset manager DWS Group noted: “New administrations tend to take a while to get up and running. Policy priorities change as events intervene. And, as far as legislation or budgets are concerned, nothing much can happen without congressional action.”

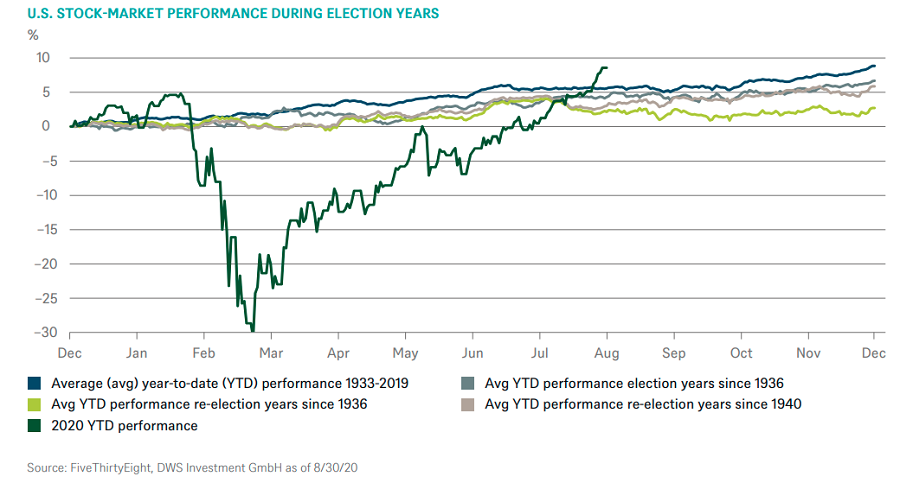

The report showed that during election years US equity markets are slightly weaker versus re-election years.

However, if you exclude the historic US re-election of Franklin D Roosevelt in 1936, much of the difference in performance in election years versus re-election years disappears.

This suggests the outcome of the US election may be slightly more insignificant than investors expect.

Clearbridge’s chief investment officer Glasser expands on this idea, showing how historically, in a unified government the stock market exhibits not much of a difference in performance.

He said that when the Congress and US president are of the same party - the stock market goes up an average of 10 per cent with Democrats in power and 13 per cent with Republicans in power.

There is more of a difference in a unified congress, however, where the US president is of one party and the Congress is of the other.

“When you have a Democratic president and a republican congress, you’re up 13 per cent. When you have a Republican president and a democratic congress, you’re up 5 per cent,” Glasser revealed.

“So roughly 800-basis point difference in a unified congress with the republicans being up 800 basis points less than democrats.”

He pointed out that in most cases, stocks are either up, or are up a lot, with the difference being when there is a republican president and democratic congress in office.

However, historians may look back at 2020 as the year of coronavirus, which will undoubtedly make this year’s election somewhat of an outlier in the data.

The risks to the market cannot be completely dismissed, as this year’s election is likely to be one of the most divisive in recent history.

As Sonal Desai (pictured), chief investment officer of fixed income at Franklin Templeton, explained: “Markets don't like uncertainty, and pretty much everything we’re seeing from how the election will be conducted makes it inevitable that we will not have an answer at midnight pacific time on the day.”

She said that uncertainty could have a negative impact on markets particularly if it appeared it was close.

“There’s scope for more unrest of different kinds,” added Desai.

Indeed, one of the emerging concerns investors have with this US election is the chance of a contested election – where the legality or validity of the result is challenged by the losing candidate.

“It’s not a good space for markets, that is a concern, and it has not been historically an area of concern,” she finished.