Investors have plenty of reasons to be spooked this Halloween as inflation sinks its fangs into longer duration assets, as increased borrowing costs make it harder for companies and governments to service their debt, and as the spectre of recession hovers over an anaemic global economy.

Andrew Eve, investment specialist at M&G Investments, said: “With persistent levels of inflation and increasing signs of weakness in the global economy, 2023 has been a scary year for everyone.”

Even in the US, where a host of commentators are predicting a soft landing, any downside shocks could rock the confidence of investors globally. As the old adage goes, when the US sneezes, the rest of the world catches a cold.

Below, the ‘Bond Vigilantes’ team at M&G outline six charts that should cause investors concern.

US government bond rout exceeds the 2008 stock market crash

Long-dated government bonds used to be considered a safe haven asset, but they have come back to bite investors, as inflation decimates their real value.

The government bond sell-off, which has gathered pace since the Covid pandemic, has now reached terrifying proportions, as the chart below shows. “The total drawdown in long-duration US Treasury bonds now exceeds the peak-to-trough stock market crash seen in the great financial crisis,” Eve observed.

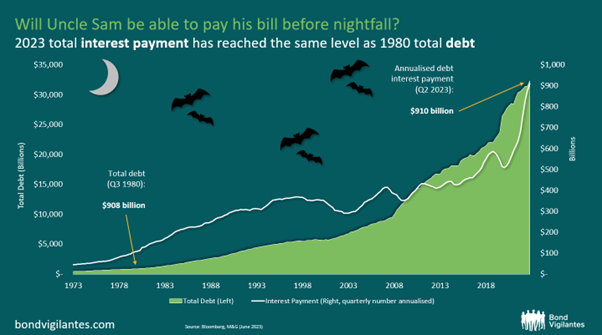

US government debt swells to scary proportions

US government debt has ballooned alarmingly. Uncle Sam faces a huge bill to pay for spending largesse during the pandemic at a time when rising rates are pushing up debt interest payments.

“Annual interest payments look like they will soon hit $1trn and are likely to rise even further as maturing debt will need to be refinanced at higher rates. In fact, total interest payments for the US have now reached the same level as their total debt in 1980,” Eve explained.

“There is a risk that rising Treasury bond supply and higher leverage will spook investors: perhaps the recent US downgrade by Fitch will not be the last. While default is highly unlikely, the increasing risk of US Treasuries is likely to be manifested primarily at the long end of the curve as market participants demand a higher term premium.”

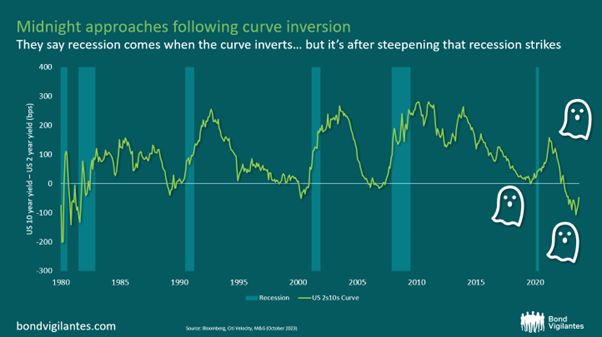

Is a US recession just around the corner, waiting to jump out?

The inversion of the US Treasury curve (when short-term yields are higher than long-term yields) is usually a sign that a recession is imminent. However, the thing to watch out for is when the curve starts to steepen again after an inversion, because that is when recession usually strikes. The curve is starting to tick upwards at the moment, potentially signalling doomsday for the US economy, as the chart below illustrates.

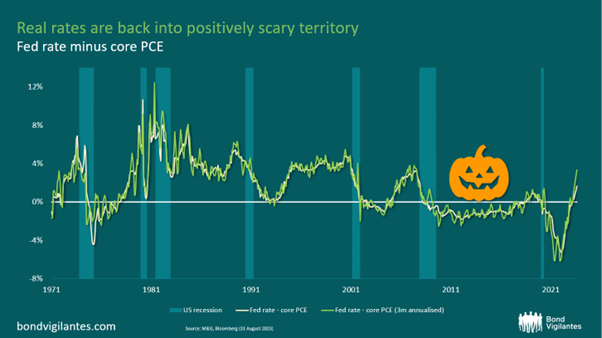

Real rates point towards a US recession

Real rates – which M&G defines as the central bank rate minus core inflation – are another recession indicator and they have been rising in recent months.

“On a year-on-year basis, real rates are now approaching 2%. Looking at more recent inflation dynamics, however, real rates just crossed the 3% mark,” Eve observed. “In the US, a real rate above 3% has traditionally been a precursor to recessions.”

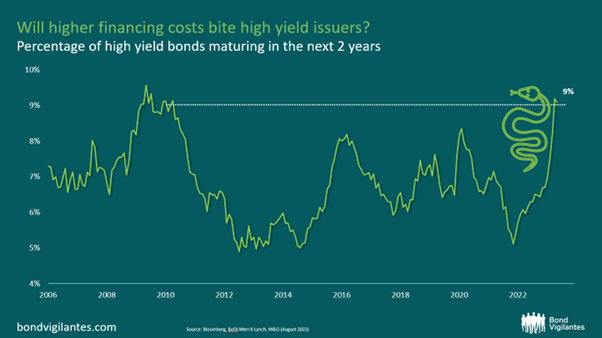

High yield spreads likely to widen when elevated borrowing costs kick in

High yield bonds are not yet pricing in increased default risk, even though most central banks have been hiking rates for the past 18 months, leading to higher borrowing costs.

The (option-adjusted) spread of the Global High Yield index has fallen to the low 400s (basis points), bringing it close to its tightest levels since the financial crisis. There is plenty of room for spreads to widen from here if darker clouds gather over the global economy.

“With many companies having put refinancing off for some time now, maturity walls are closing in: nearly 10% of high yield issuers face refinancing risk in the next two years. This is likely to become the largest refinancing effort for high yield issuers since the global financial crisis,” Eve said.

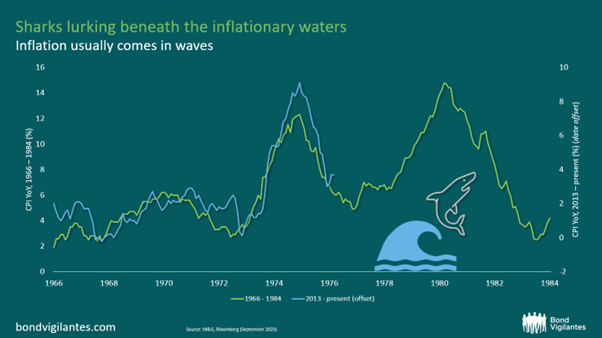

Inflation could surge to 1970s levels

Inflation does not increase in a straight line; it usually comes in waves as governments and central banks attempt to combat it. After decades of low rates and low inflation, we need to look back to the 1970s to find a time when inflation dynamics look similar to the present day.

“Back in the 1970s we had two big waves of inflation before then-Fed Chair Volker finally managed to put the inflation genie back in the bottle,” Eve warned. This suggests that inflation could make a comeback.