Inflation is trending downwards but has not yet been vanquished and could prove stickier than expected, leading to some tough times in markets, according to Karen Ward, chief market strategist for Europe, the Middle East and Africa (EMEA) at JPMorgan Asset Management.

In the coming years, investors should expect more frequent cost shocks, which would be detrimental for equity and bond markets, as took place in 2022.

Ward said investors should prepare by building “a portfolio fit for the future” that includes alternative investments to hedge against inflation.

“Inflation is the critical topic for investors,” she noted. After 20-30 years of low inflation, 2022 served as a reminder of “how difficult cost shocks are. Neither bonds nor equities like cost shocks.”

Over the next few years, “we’re going to have more 2022s,” Ward said – scenarios where inflation rises, “central banks slam on the breaks”, and bonds and equities tumble.

Bonds provide diversification against growth shocks but they do not protect portfolios from inflation, she noted. “What 2022 taught us is that there are very few places to hide when the problem is inflation.”

That’s where alternative investments come in; they provide diversification that investors can’t access in the public markets. Some alternatives do well when inflation rises, such as timber. “Timber loves inflation, it can’t get high enough,” she said.

Ward also thinks private equity has a role to play in portfolios. Start-ups used to list after four years but now companies are waiting an average of 12 years before going public. “So if you want that exciting, early stage, dynamic growth, you’ve got no choice but to look at private equity.”

For now, however, inflation appears to be tamed and her base case is for inflation to get down to 2-3% in the near term. “It does look like we’re in the last mile and inflation is falling back to target,” Ward said. “That’s good news for businesses.” The much-anticipated recession has not happened and “the direction of travel from here is for the global economy to accelerate.”

That does not preclude inflation from rearing its ugly head again in the coming years. “We are not completely out of the inflation woods,” she warned; “we can’t be complacent.”

Even so, Ward expects the US Federal Reserve to cut rates this summer. “[Fed Chairman] Jerome Powell told us there’d be cuts and now he has no choice but to deliver.”

Rates will stay higher than they were before the pandemic, but “that’s a good thing”, she continued. Zero rates were “a sign of ill health and a sign that our economy is struggling.” Zero rates had a negative impact on some asset classes such as bonds and emerging markets, she pointed out.

“I don’t think we’re going back to zero rates. I don’t think we’re going back to quantitative easing, but good riddance to it, it was a sign of ill health.”

Against that backdrop, Ward expects the yield on 10-year Treasuries to hover around 4-4.5% this year. Yields of 4-5% on high quality bonds look “pretty attractive” given her base case expectations for rates and inflation this year. “Locking in those bond yields should be a key part of our strategy.”

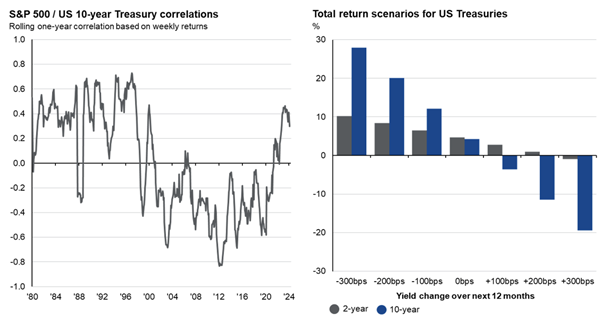

Bonds should provide decent returns if interest rates are cut and yields fall, in addition to portfolio diversification against potential growth shocks, as the charts below show.

Source: JPMorgan Asset Management’s Guide to the Markets, Bloomberg. Chart indicates the calculated total return achieved by purchasing US Treasuries at the current yield and selling in 12 months’ time given various changes in yield.

“Bonds are supposed to be nice and boring. Now they’re back filling that boring role in the portfolio – nice, steady income, and returns if there’s a growth shock,” Ward concluded.