Markets have surprised to the upside in the first half of 2024 and rewarded investors who have been taking on more risk.

With the dovish comments made by Federal Reserve governor Jerome Powell, the S&P 500 jumped to new highs by the end of March and consensus has now crystallised on a soft-landing scenario, where central banks gradually get inflation back to 2% without crashing the economy.

This should be encouraging for the bulls out there, who see this as an occasion to load up on risk. But Sam Witherow, co-manager of the £707m JPM Global Equity Income fund, went the other way. He believes investing in the cyclical areas of the market – even if they should presumably benefit from the current market backdrop – will not reap the rewards investors are hoping for.

“It seems very possible that the Fed is going to pull off a soft landing, I don’t deny that. It seems like a very credible outcome,” he said. “But this is pretty much fully discounted within equity markets and therefore there's not a lot of reward for owning these stocks if that plays out.”

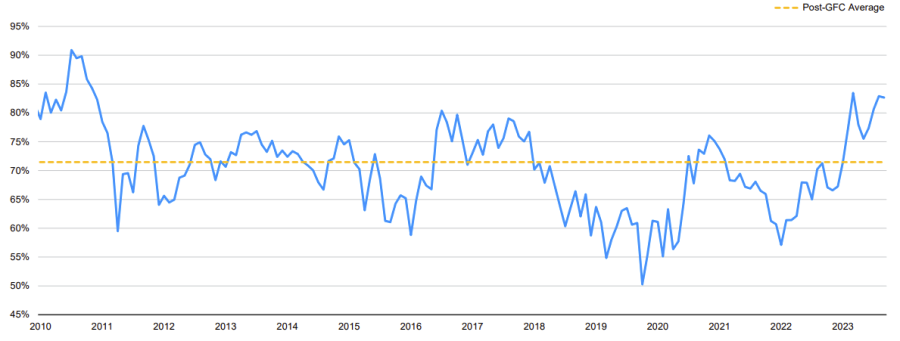

To prove this, he showed the chart below, illustrating estimated relative long-term valuations of the most cyclical stocks (think cruise lines or cars) versus the most defensive stocks (such as regulated utilities or consumer staples products).

Long-term P/E estimates of cyclical vs. defensive stocks

Source: JPMorgan AM, Bloomberg.

Typically, the line in the chart (representing relative premium for the cyclical stocks) goes up at periods of euphoria.

It happened in 2017 around the Donald Trump tax cuts and in 2021, when the West quickly recovered as it came out of the pandemic. It is also happening again now, the manager explained.

“While there isn’t much reward in a soft landing, if one doesn’t happen and higher-for-longer rates start to really bite, or if there's some other exogenous shock, you get a very big pay-off from more defensive stocks,” said the manager.

“So in our global portfolios, we've now tilted to be quite defensive and that's also true within our global equity income portfolios.”

As for what that exogenous shock might be, the manager abstained from making predictions, saying that “stuff happens” that upsets narratives, so investors should be prepared.

“It’s one of those things – you never know what the exogenous shock is going to be. We went further into defensives in early 2022, obviously not knowing that there was going to be a tragic war in Europe, but it happened and the pay-off of owning them suddenly kicked in,” he said.

“That said, a small disappointment can also play a role, for example when growth isn't quite as good as people expect. A company growing at 12% when expectations were at 14% can prompt a pretty vicious derating. We have seen that time and time again when the elastic of valuations get stretched.”

While remaining conscious about valuations, one of the areas Witherow is more bullish on is semiconductors, an area of the market that has rocketed in recent years on the back of the artificial intelligence (AI) wave.

However, he is not keen on these companies for the reasons that growth investors are positive, but rather for mere supply-demand movements.

Demand for chips during Covid has generated supply shortages, which pretty quickly turned to glut and companies have been massively destocking.

“While the actual underlying demand growth is accelerating thanks to digitalised factories, buildings and cars, we are now way below trends in terms of growth for demand,” said Witherow.

“This to us is the best time to invest in broad-based semiconductor companies supplying quite boring chips that don’t come at huge premiums. But you want to do that now, when they're at the peak of the destocking cycle, because you know that's going to rebound back.”

On the flip side, consumer staples is an area that the manager is still looking at with some caution.

“Consumers have been shrinking their baskets after waking up to the fact that, since Covid and the war in Ukraine, supermarkets have taken advantage of their pricing power and we're now seeing negative volume growth for many supermarkets,” he said.

“We now need to get back to positive volume growth in order for the industry to cover their fixed costs, and we need a handoff between pricing-led growth to volume-led growth. The big question is how, and we think it can still be messy handoff.”