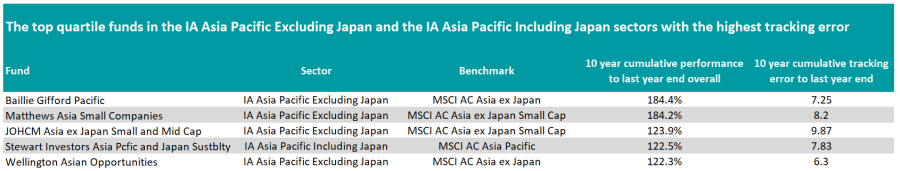

Five Asia-Pacific funds managed to deliver top-quartile returns in the past 10 years by ignoring their benchmark and offering something significantly different, data from Trustnet has revealed.

In this series we identify funds with a high tracking error that beat their benchmarks and sit in the top quartile of either the IA Asia Pacific Excluding Japan or IA Asia Pacific Including Japan sectors.

In the IA Asia Pacific Excluding Japan sector, JOHCM Asia ex Japan Small and Mid Cap is the top-quartile fund that has deviated the most from its benchmark - the MSCI Asia ex Japan Small Cap index - over the past decade.

Manager Cho-Yu Kooi follows a bottom-up investment approach, looking for Asian small- and mid-cap (SMID) businesses that can grow over economic and liquidity cycles and that can create high returns on the capital they employ.

According to FE Analytics, information technology is by far the largest sector weight in the fund, as it accounts for 33.5% of the portfolio.

The fund also has a geographic bias towards Taiwan and India, as both countries make up together nearly 60% of the portfolio.

Another focusing on SMIDs also made it to the list. Matthews Asia Small Companies has strayed less from the MSCI Asia ex Japan Small Cap index than the JOHCM fund, but it has given better returns to investors in the past 10 years.

Manager Vivek Tanneeru also favours the information technology sector, but has a stronger focus on China and Hong Kong, which is the largest geography weight in the portfolio and the biggest overweight relative to the benchmark.

However, Baillie Gifford Pacific is the ‘rebel’ fund in the IA Asia Pacific Excluding Japan sector that has made the most money for its investors, growing 184.4% over the past decade.

The fund follows a bottom-up ‘best-ideas’ approach, focusing on secular growth companies that are well positioned to benefit from technological change and disruptions.

It also favours owner-managed companies, as the managers believe this can ensure better long-term stewardship and alignment with shareholders.

Analysts at Rayner Spencer Mills Research warned, however, that the fund’s approach is likely to result in lumpy performance, as the managers are not trying to deliver consistent incremental index outperformance on a year by year basis.

They added: “The fund is particularly suitable for investors prepared to take a longer-term view who are willing to ignore short-term noise, and those looking to capitalise on secular growth opportunities in the region.”

Roderick Snell has been managing the fund since 2010 and was joined by Ben Durrant in 2021.

Wellington Asian Opportunities achieved the same feat as the three previous funds, but has returned less to investors while not straying as much from its benchmark.

Source: FE Analytics

The fund looks for undervalued quality companies, which manager Niraj Dilip Bhagwat believes to be capable of delivering sustainable growth. The fund employs ‘ecosystem analysis’ in its investment process, which includes meeting with its investee companies’ competitors, suppliers and customers.

Finally, Stewart Investors Asia Pacific and Japan Sustainability is the only top-quartile fund in the IA Asia Pacific Including Japan sector that has a high tracking error.

FE fundinfo Alpha Manager Douglas Ledingham is benchmark-agnostic and invests in quality companies that contribute to sustainable development. While seeking to achieve capital growth, the fund also focuses on capital preservation.

Previously, we have looked at the global, US, UK, European, Japanese, small-cap and emerging markets funds that have achieved a similar feat.