Economics students the world over learn about the law of competition, which suggests that companies making supernormal profits attract competitors, forcing down their returns on capital.

The market, believing this rule, assumes that for many high-returning businesses a downward trajectory of returns will begin at some future point. This is what gets factored into the share price, said Lazard Asset Management’s Barnaby Wilson and Louis Florentin-Lee, who have been managing the £413.6m Mid Wynd International Investment Trust since October 2023.

But the truth is that this rule gets broken all the time.

“This economic law is very often wrong, and that’s a good thing that actually allows us to have this job. Some companies in the real world are able to build sufficiently strong competitive advantages or economic moats around them that will insulate them from the competition,” Wilson explained.

“Microsoft's been doing it for 40 years, Coca-Cola for probably double that and Louis Vuitton for double Coca-Cola. If the law of competition really worked everywhere, their success should never have been possible.”

Despite these businesses’ track records, the market continues to price them as if they will correct downwards at some point in the near future.

Microsoft is Mid Wynd’s largest holding, making up 5.4% of the trust’s portfolio.

Another example of a ‘rule breaker’, where there is a mispricing opportunity, is Accenture, which the managers have held since its inception in Feb 2011.

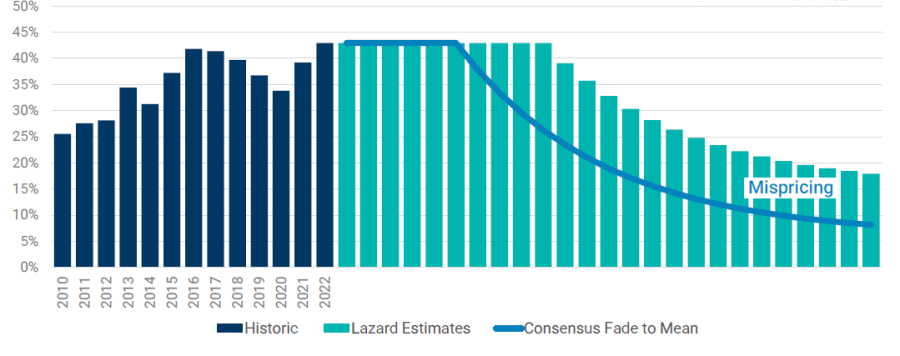

“The market is assuming that Accenture’s current level of returns at around 40% CFORI [cashflow return on investment] will only last for six years before it starts to fade, but we believe its competitive advantages will enable it to sustain those returns for much longer than six years,” Wilson continued.

“Finding companies that are going to maintain their high level of returns on capital for longer than the market expects is in a nutshell what we do.”

Accenture’s financial productivity

Source: Lazard

Wilson summarises this approach as “invest in compounders exploiting the market misconception that all high returns fade over time.”

It is a tactic he and Florentin-Lee have introduced to Mid Wynd, which was previously a thematic strategy under the management of Artemis’ Simon Edelsten and Alex Illingworth.

Wilson and Florentin-Lee inherited the trust’s leadership in October 2023 and have maintained only six of the original names, including Microsoft; the rest of the portfolio has been completely overhauled, its exposure to US-based financials, industrials and technology increased and European healthcare and consumer staples cut.

“In less than a week's time, we transitioned the old thematic, top-down portfolio to our bottom-up global quality growth strategy, with a total of 40 to 50 stocks with great conviction behind them,” Wilson said.

One of the stocks with most conviction, as already mentioned, is Accenture, which the managers see as “extremely well positioned to take advantage of the fundamental technology rewiring” that almost all global companies around the world are going to have to go through.

“Decisions around tech are moving away from the realm of operating efficiency and landing squarely on the desk of CEOs around the globe. Artificial intelligence, cloud, cybersecurity and digital marketing are all becoming of strategic importance,” said Wilson.

“Accenture's heritage back in its consulting days puts it really in pole position to be able to advise on these massive transformational projects. That’s its competitive advantage and its moat”.

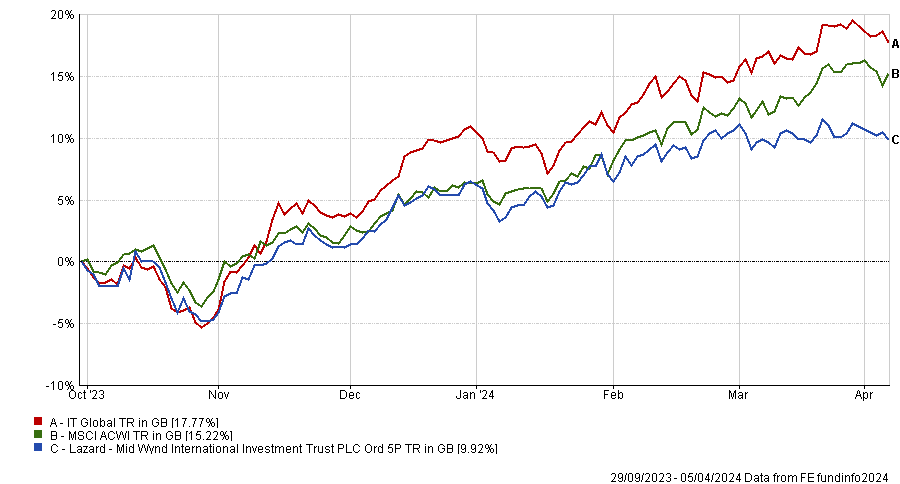

Performance of fund against sector and index since Lazard’s leadership

Source: FE Analytics

Away from large caps like Microsoft and Accenture, the new managers also invest in smaller companies in nicher areas, where it’s even more difficult that competitors come in to compete for profits.

It’s one of the main differences between Mid Wynd and Terry Smith’s Fundsmith.

“Smith’s motto is to buy great businesses and then do nothing. We're in that camp, but there's plenty of difference in the way we express that and in the names that we own, even if the overall philosophical approach might be reasonably similar,” the manager explained.

“One of the big differences is that Smith’s exposure is much more towards the mega-cap stocks, whereas we feel that we can find very interesting and compelling small and mid-cap opportunities as well.”

One such example is the “world's leading anime company”, Toei Animation in Japan, whose intellectual property contains shows such as Dragon Ball and One Piece.

“It is a wonderful business that dominates a niche industry and makes great returns on capital. Obviously it’s well established in Japan, but still a tiny part of the media industry and growing very quickly in markets such as the US and China.

“It’s unbelievably unlikely that platforms such as Netflix, Amazon or Disney should decide to make their own content in this space, because the best animators are attracted to Toei, which is very broadly broadcast in Japan and a good launch pad for anime shows. Also, Toei’s biggest shareholders are the Japanese broadcasters, so it's quite a cosy shareholder arrangement.”

Under the new management since the end of 2023, the trust has returned 9.9%, as shown in the chart above. It narrowed its 12-month average discount of -2.08% to the current -0.64%.