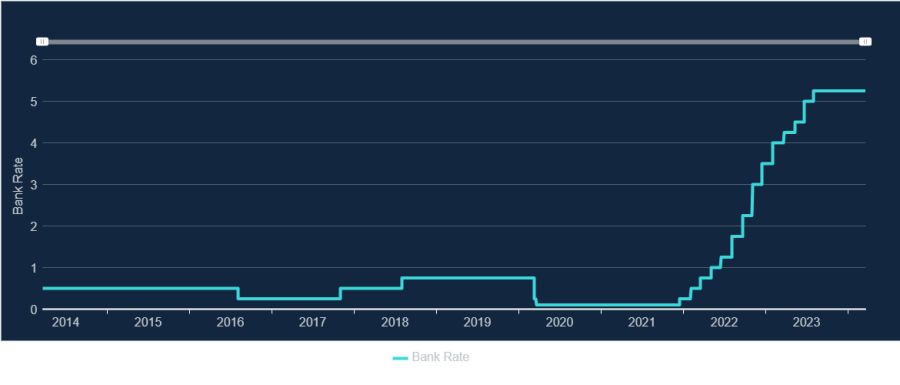

The Bank of England chose to maintain rates at 5.25% despite yesterday’s February inflation reading coming in lower than expected at 3.4%.

Policymakers in the Bank’s Monetary Policy Committee (MPC) were widely expected to keep rates on hold for the 14th meeting in a row, following one of the most aggressive hiking cycles in history.

The votes were eight to one in favour of maintaining rates, with the one dissenting voice calling for a 0.25 percentage point drop. Last month, two members voted for a 25 basis point rise and one voted to cut.

Bank of England interest rates

Source: Office for National Statistics

They initially increased rates to combat rampant inflation, which has simmered down in recent months and is nearing, although not quite at, the Bank of England's 2% target.

Inflation is expected to reach the 2% target in the second quarter of this year, the Bank statement noted, but could rise again in the following six months on the back of higher energy prices.

It also highlighted that services consumer price inflation (CPI) – a key metric for policymakers – is falling but remains high at 6.1%.

Richard Garland, chief investment strategist at Omnis Investments, said: “Despite the recent sharp fall in core inflation it is still too soon for the Bank of England to consider cutting interest rates. Wage growth and service sector inflation are both still too high and sticky for comfort."

They are moving in the right direction however, which means that a new cycle of interest rate cuts should emerge in the summer.”

Expectations of interest rate cuts have cooled in recent months, data from Waverton Investment Management shows. From January to early March, the number of market-forecasted interest rate reductions has dropped from five to three. At the start of the year, rates were expected to end 2024 around 4% but this rose to 4.5% by early March – where it remains.

Garland said investors should anticipate the first rise in the next two quarters. "They are moving in the right direction however, which means that a new cycle of interest rate cuts should emerge in the summer.”

Higher rates have led to weaker economic growth – as consumer have spent less during the cost-of-living crisis – and the Bank has come under pressure to act after the UK dipped into a technical recession at the end of last year, according to data from the Office for National Statistics.

Richard Carter, head of fixed interest research at Quilter Cheviot, said: “The Bank has a difficult balancing act ahead of it as, though it will be reluctant to move too much too quickly, it also risks being overly constrictive if it holds rates at this level for too long, so we are likely to see the first cut being made sooner rather than later.”

The Federal Reserve also maintained US rates at the 5.25%-5.5% range last night. Another widely expected move, it shows the central bank is focused on achieving a soft landing, according to experts.

Richard Carter, head of fixed interest research at Quilter Cheviot, said: “Despite facing pressures from various economic indicators, the Fed has chosen a cautious approach, emphasising the importance of a data-driven strategy before making any adjustments to the rates.”

Inflation (3.2%) remains above the 2% target and the central bank members noted they want wanted to see clear signs this is continuing to move down.

“Analysts had previously anticipated a more aggressive rate-cutting schedule but have since recalibrated expectations, aligning them more closely with the Fed's cautious stance. The consensus seems to point towards maintaining the status quo until more persuasive data emerges,” said Carter.

Charles Hepworth, investment director at GAM Investments, said the median dot-plot for next year has now risen from a previous forecast of 3.6% to 3.9%.

“This could be seen as bearish for markets but for now they are happy that they will receive three cuts this year still,” he said.

Gerrit Smit, manager of the Stonehage Fleming Global Best Ideas Equity fund, added the Federal Reserve is in a “relatively comfortable position” with a “double package” of the US economy currently not needing its support, and US inflation under control.

“It is, therefore, no surprise that they are not cutting their target rate or indicating one as yet. Risk assets enjoy a ‘goldilocks’ economic backdrop, further supported by the Fed saving its ample reserves for when it may be needed. Our view remains that the first rate cut may only happen in the second half of the year.”