Vanguard LifeStrategy 80% Equity and BNY Mellon Multi-Asset Global Balanced outperformed the sector average in every year of the past decade, gaining the title of most consistent strategies, according to the latest Trustnet study.

They both got there through different paths – the popular £10bn Vanguard LifeStrategy 80% Equity fund is a passive strategy investing 80% of its assets in Vanguard’s own global equity passive funds and the remaining 20% in its fixed income passive range, all the while charging an attractive 0.22%.

Meanwhile, the £576.9m BNY Mellon Multi-Asset Global Balanced is an active fund, co-managed by FE fundinfo Alpha Manager Bhavin Shah and Paul Flood. As at the end of February, the portfolio was split between 74.2% in equities, 18.7% in bonds and 7.1% in cash and its ongoing charge figure (OCF) is 0.5%.

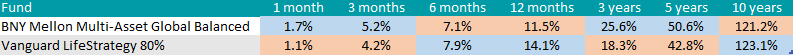

The two vehicles tend to perform better at different times, albeit with similar returns; the Vanguard fund took the lead over the past 10 years and 12 months, but the BNY strategy caught up and beat it over five and three years – as the table below shows.

Performance of funds over multiple timeframes

Source: FE Analytics

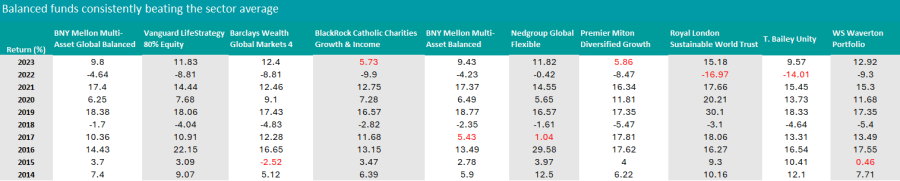

No other fund in the IA Mixed Investment 40-85% Shares sector managed to match the level of consistency of these vehicles, but as many as eight went close and outperformed in nine years out of 10.

One of them is another of Shah’s funds, the £3.2bn BNY Mellon Multi-Asset Balanced, whose key attractions, according to Square Mile analysts, are “the conviction-driven approach taken by the managers, the experience and tenure within the business of the lead manager and the well-regarded global analyst team”.

Source: Trustnet. The red highlight indicates underperformance against the sector average.

A fraction smaller, at £3.1bn of assets under management, Royal London Sustainable World Trust also stood out.

Square Mile analysts Alex Farlow and Charlie McCann said: “Royal London’s sustainable range truly lives up to the claim of having environmental, social and governance (ESG) considerations integrated into its processes.”

“We see the fund as a strong option for investors who wish to invest in a mixture of equities and bonds from companies with sustainable business practices and like it that the team strongly believes it can add value as a consequence of its process, and not that it limits potential returns.”

The managing team includes Alpha Manager Mike Fox as well as George Crowdy and Sebastien Beguelin.

The other funds on the table are much smaller in size, but a few of them were still noteworthy, such as the £450m Premier Miton Diversified Growth fund, which only fell below the average peer in 2023.

The investment team, led by manager Neil Birrell, assesses the macro and economic environment together with the absolute and relative attractiveness of asset classes, combined with their potential risk profile and relative risk-adjusted returns, to determine the fund’s asset allocations, which vary between fixed income (currently at 20%), equities (56.2%), property (10.2%) and alternatives (11.6%).

RSMR analysts said: “The asset allocation parameters are very flexible, enabling the management team to respond quickly to changing market conditions and this flexibility has proved effective in helping the funds to remain competitive over some difficult market environments.

“Overall, we believe the Premier Miton Diversified funds are a good choice for an investor seeking a genuine multi asset proposition that has the capability to generate some competitive risk adjusted returns over differing market cycles.”

We conclude the review with the £471m WS Waverton Portfolio, a five FE fundinfo Crown-rated fund managed by James Mee, which outperformed the rest of the sector in every year of the past decade except for 2015.

Of the active strategies in the list, Nedgroup Global Flexible is the most expensive, with an OCF of 1.08%, and the cheapest, at 0.45%, is Barclays Wealth Wealth Global Markets 4

This article is part of an ongoing series on consistency. Find the previous instalments here: Cautious funds, Emerging Markets, IA Global, Europe, IA UK Equity, IA UK Equity Income, UK Small Caps, UK bonds.