The market is “marching towards potential overheated territory” but investors should continue to ride the momentum trade for as long as they can because now is a “nirvana” for diversified portfolios, according to TAM Asset Management’s UK chief investment officer James Penny.

Equities have been on a tear to start the year, with the asset class providing strong returns for investors, but there are concerns that this momentum could ultimately lead to its downfall.

Some of the problems are being “masked” by the interest rates debate – with too much emphasis placed on the words uttered by central bankers at their meetings – a term Penny called ‘Fed speak’.

“People’s obsession with Fed speak is potentially overshadowing some things in the market which, if Fed speak wasn’t around, would have caused more volatility. But they haven’t,” he said.

This includes geopolitical uncertainty around the US and China, two wars (one in Ukraine and the other in the Middle East) and questions over economic growth, which are on top of the concerns surrounding inflation and interest rates.

Yet it is only the latter that the market is concerned about. Even inflation, which is yet to get down to central banks’ targets, has largely been ignored, he argued.

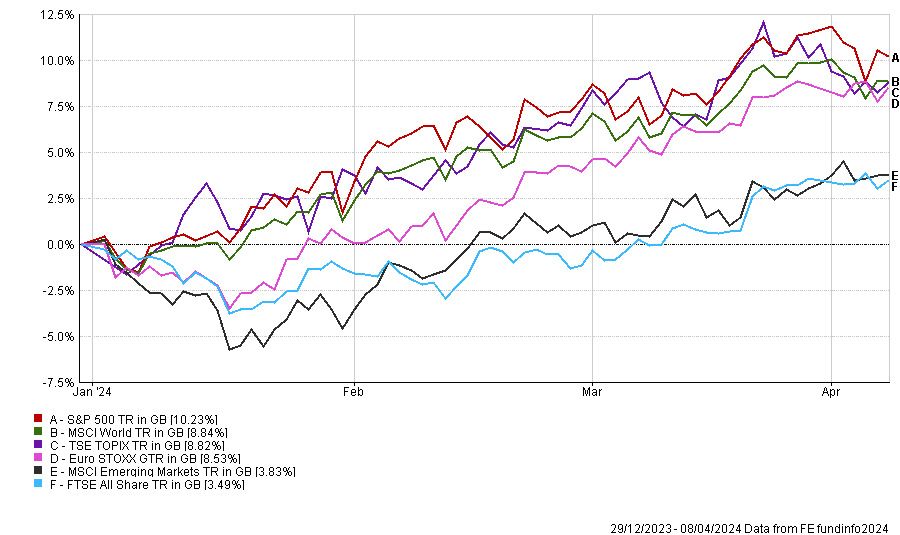

However, investors seem unconcerned, highlighted by the fact that every major equity market is up so far this year.

Performance of indices over YTD

Source: FE Analytics

“It definitely feels like this market is accelerating, and it is doing so in the face of geopolitical or macro uncertainties that haven’t gone anywhere,” said Penny.

The S&P 500 set a new record high earlier this year, with some analysts having to re-evaluate their forecasts for the year because they have already been hit in the first quarter, the CIO said. Meanwhile the UK and some European markets are teetering near their all-time highs as well.

“If that keeps happening and if the market keeps rallying all year without taking into account inflation or the trajectory of interest rates or economic uncertainty, you’re going to find yourself in a more expensive market,” he said.

“So, if we are talking about that carrying on all year we could be in a spot where price reconciliation needs to happen.”

However, he noted that he does not want to “scaremonger” investors because now is the first time in more than 18 months where diversified portfolios can make good returns.

Many model portfolio services (MPS) were hit hard last year as the market rally centred almost solely around the ‘Magnificent Seven’ technology stocks, but this positivity has broadened out to other parts now as well.

“It is no longer just the Magnificent Seven, you are starting to see [market performance] broaden out to the other sectors and areas such as Europe, the UK, value and cyclical investing,” said Penny.

“People are coming back to areas they wouldn’t have allocated to last year. That is nirvana for a diversified portfolio manager because the bull market is still here but it is no longer oscillating around seven stocks.”

As such, he said he is “moving with the market” in his portfolios. When it becomes more bullish, he is being positive and when there are signs of people becoming overly bearish, he is taking risk off the table ahead of time.

In equities, he is confident on the US, but is focusing on “the other 493 stocks in the S&P 500”, as well as smaller companies, where his fund selection – Pacific US Smaller Companies – made a 9% gain in February alone. This is another sign that the market could be heating up, he noted.

Elsewhere, Europe is “starting to look really good”, he continued. “There are some phenomenal companies there – especially value which hasn’t had a great time so far but that could be primed for some real positivity.”

Japan is another on the rise, although this has been well-documented. He said there is “a bit of concentration risk there” but noted that with conditions improving the bull market could become “more ingrained and more momentum-driven”.

Emerging markets too could benefit this year from dollar weakness, which should occur when the Federal Reserve starts to reduce interest rates.

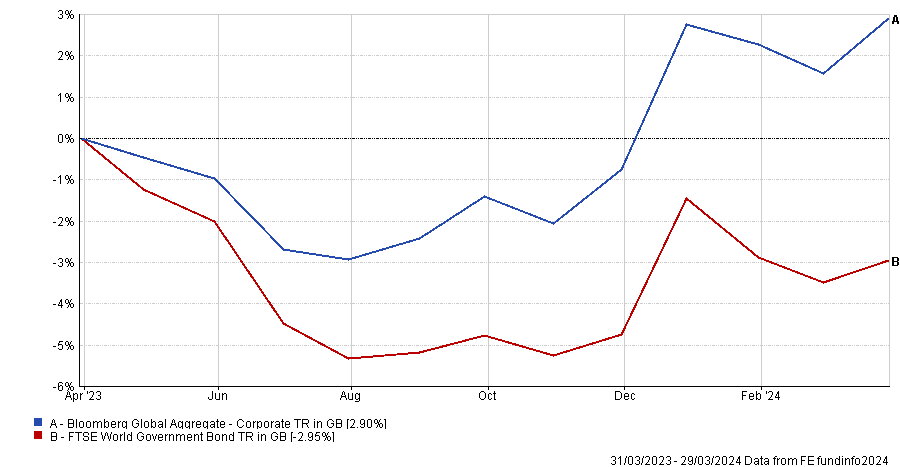

In the bond space returns have been more muted as they “can’t get out from underneath this inflation-is-here-to-stay cloud”. However, there are pockets performing well, particularly in the high yield and credit markets, where Penny has a higher allocation at present.

Performance of indices over 1yr

Source: FE Analytics

“The positivity in the market continues to be in the corporate space and high yield areas. That’s why spreads are so tight. No one wants to be in the government space,” he said.

“We have a much bigger position in the corporate part than the sovereign part,” Penny added, but he noted that investors will need to move quickly if conditions change and there is a pullback later in the year.

“Should we hit a recession that part of the market is under owned and oversold. So, if you start to see economic weakness coming through you will have to be quick to move from one to the other as corporates will suffer under economic strain and the sovereigns will be exactly what you want to own in that environment,” he added.

Despite the strong markets, he also said there are compelling reasons to hold alternatives – typically viewed as must-haves when equities and bonds are going sideways, but which investors tend to shun when traditional asset classes are rising.

“You should always have alternatives,” he said, noting that his main holdings in this area are Amundi Volatility – a hedge against the market selling off – and Ruffer, which had a tough time last year but is “primed for volatility”.

“Much like government bonds, if you can switch into more defensive alternatives at the right time I think that will do very well,” he said.

Jupiter Gold And Silver – which plays into under-owned miners as well as the burgeoning gold price – is another holding, although this is more of an alpha story in the current market.